| Vicky De Souza |

Manila |

|

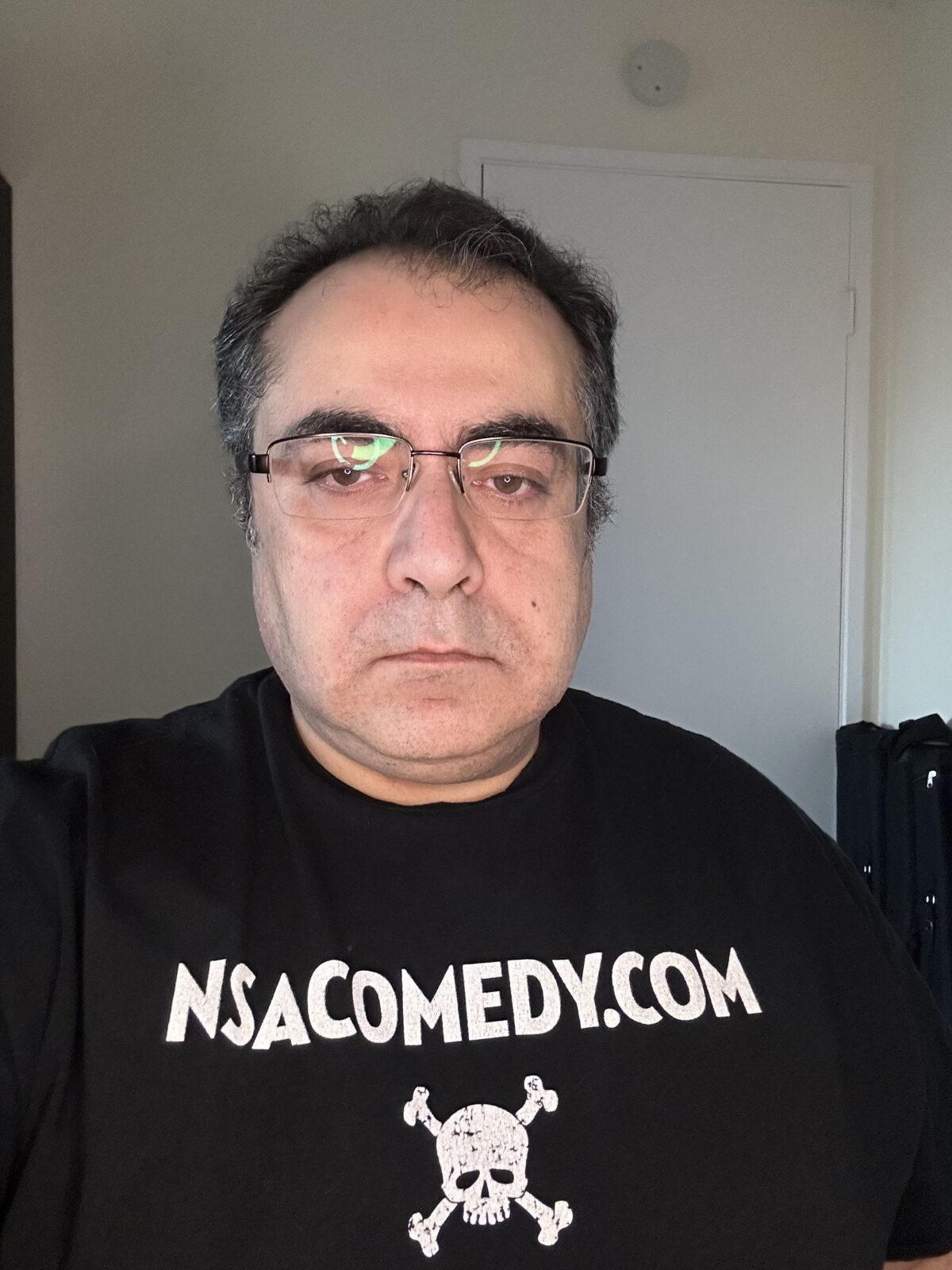

| F. Qureshi |

|

|

| Sophia Akram |

London |

|

| Sara Alsherif |

|

|

| Griff Ferris |

London |

|

| Sofia Lyall |

London |

|

| Dr Syed Mustafa Ali |

London |

|

| Bana El Assi |

|

No one should ever be terminated for voicing their opinion especially on a humanitarian issue. Free Palestine 🇵🇸 |

| Rasha Lababidi |

Montreal |

|

| Yasser Khan |

London |

|

| Haleema Qazi |

Pittsburgh, PA, USA |

The hypocrisy of SKR is glaring! “Killer robots” are literally being used against Palestinians, and you’re silencing and punishing those who speak out against it. You’ve lost all legitimacy if you don’t take the steps outlined in the letter. |

| Ameer shaheed |

|

|

| Tarik Chardon |

Genève |

|

| Emile Harding |

Geneva |

|

| Huda Kitmitto |

Geneva |

|

| Tamara Enomoto |

|

|

| Shahrzad Ghorban |

Geneva |

|

| Yousef |

Amman |

|

| Esraa Mahmoud |

Haarlem |

|

| Lukindo mbuli |

Geneva |

|

| Imane M |

Paris |

Cease fire on Gaza!

SKR is supposed to be exemplery and neutral! |

| Janet Weil |

PALM DESERT |

All best wishes to Ousman Noor. |

| Taner Bodur |

Melbourne |

|

| Shamshad Muscati |

Rancho Cucamonga, California |

I emphatically believe Ousman was unfairly dismissed for speaking the truth. As the world can witness the war crimes the killing of innocent Palestinian civilians continues. |

| Nada Tarbush |

|

|

| Rajae el Haddar |

Amsterdam |

|

| Ebnomer Taha |

Zürich |

|

| Saleem Rashid |

Sheffield |

|

| Hawwa bobat |

|

|

| Sherry Khan |

New York |

|

| Cristina Deptula |

Davis |

|

| Ross Rice |

San Francisco |

|

| Raul Delarosa |

San Francisco |

|

| Despoina Maniadaki |

Geneva |

|

| Ydraios Georgios |

Geneva |

|

| Maung Zarni |

London |

It is morally and professionally unacceptable that SKR has joined many institutions that have now made McCarthyite policies of Censorship. ISRAEL IS ONE OF THE FRIGHTENING MILITARY-INDUSTRIAL COMPLEXES THAT TEST AI-GENERATED AND OTHER WEAPON SYSTEMS IN “THE PALESTINE LABORATORY.” Ousman was doing what a moral, principled and compassionate human would do. |

| Tania Bukhari |

|

Good luck, we demand justice be done! |

| Shaheen Munshi |

London |

|

| Abdiaziz Farah |

Melbourne |

|

| Entela |

Granada |

|

| Sean Sinanan |

London |

|

| Vesna Strugar |

Bsograd |

|

| Dario Armani |

Trieste |

|

| Melissa Short |

Berkeley, CA |

Stop killer robots and killer governments and killer subcontractors NOW. Stop the killing! |

| Robert Jones |

Weston-super-Mare |

|

| Chris Jones |

London |

|

| Seed |

Paris |

|

| Sanna Khawaja |

LONDON |

|

| Nabil Elassi |

Dubai |

|

| Elham Tarbush |

|

|

| Leila White |

London |

|

| Ayan Absia |

London |

|

| Gregory Proch |

Paris |

We will overcome |

| TK |

Warwickshire |

|

| Syed Hammad Ahmed |

Aylesbury, Buckinghamshire |

I salute your efforts for humanity. Keep it going. |

| Natasha Malik |

Hamilton |

|

| Tania B |

Beirut |

Thank you for being brave and standing for what is right |

| Rafiq Lababidi |

Dubai |

|

| Dima Asfour |

|

|

| Qais Kasabri |

New York |

We seek justice for every and each human |

| Zainab |

|

|

| Bushra Ebadi |

Toronto |

|

| Zaid Bustami |

Montreal, Canada |

|

| Sidrah Qureshi |

Melbourne |

|

| Clarissa Mansfield |

Bellingham, WA |

|

| Rana Ar |

Amman |

|

| Natalie Kabasakalian |

|

|

| Carla Lafortune |

Saco |

|

| Gail Nestel |

|

|

| Humera Noor |

Birmingham |

|

| Adil kham |

|

|

| Sherif Shafie |

Dubai |

|

| Kristen Otenti |

|

|

| R Belmouloud |

London |

The truth cannot be suppressed |

| Saba Faruqui |

London |

|

| Renata wimer |

Mexico city |

|

| Sherif Shafie |

Dubai |

|

| Damon Ramsey |

Vancouver |

Free Palestine! |

| Rahet N |

Scotland |

|

| BENDAHMANE |

|

|

| Tania Haque |

Manchester |

|

| Sonja |

Bernau bei Berlin |

|

| Rasmus Hemse |

Stockholm |

|

| Elena |

|

Good luck 🙌✌️ |

| Shahzad Khan |

Ottawa, Ontario, Canada |

|

| Thomas Li |

Oxford |

Would someone have been dismissed for expressing solidarity with Israel following Oct 7th? If not, then a troubling and obvious double standard exists here, one which is likely to bring grave disrepute to the stated aims of this organisation and its leadership. |

| Nergiz |

London ON |

|

| Roelof Bijkerk |

|

|

| Ziena eldieb |

Cairo |

|

| Arsalan Akhtar |

London |

|

| Carol Grayson |

Newcastle Upon Tyne |

|

| Maureen Kelsey |

Palermo |

|

| Ahmed Zayan |

Seattle |

Free Palestine |

| Patricia Carbajales-Dale |

Seneca, South Carolina |

I am sorry this has happened to you. |

| Hala Kitmitto |

San Diego |

Justice is a moral obligation |

| Micheal Jones |

London |

Disgusted at both your silence and your treatment of this man. |

| Harry Groome |

|

|

| Thaminah Choudhury |

|

|

| Stephen Olive |

Merseyside |

|

| Umar Carter |

Chicago |

|

| Sameer Hasan |

|

|

| Sheila Hughes |

|

Free Palestine and end the genocide!!! |

| Susan Phillips |

Alexandria |

|

| Carolina Romero |

|

|

| Zogherah |

Jhb, South Africa |

|

| Shirley |

Jakarta, Indonesia |

|

| Julie-Anne |

|

|

| Zain Esseghaier |

|

|

| Hamzeh alodat |

Riyadh |

|

| Sarah Streatfeild |

London |

|

| Mark Billing |

Wirral, UK |

|

| Sunil Chodha |

Londom |

|

| Sarah Taylor |

|

|

| Rayeena |

Plainfield, Illinois |

|

| Sean Hurley |

Hamilton |

|

| Evan Cofsky |

Los Angeles |

|

| Nader El-Masri |

London |

Free Palestine |

| Sameena Ahmad |

Chorley |

|

| Hamdy Hassan |

Benicia, California. |

|

| Majid Freeman |

Leicester |

Respect for taking a stance and for speaking up. Keep up the amazing work. We need to continue speaking up for justice for ALL. |

| S Naseem |

|

|

| Stanice |

London |

|

| Andy Platt |

Nottingham UK |

|

| Joey Rettner |

London |

|

| Patrick Shi Timmer |

|

|

| John Mahon |

Washington DC |

|

| Sajjid Zeeshan |

London |

|

| Shereen Alima |

London |

It’s a disgrace that you fired ousman for speaking out against the bombing of babies |

| Shabina Khalifa |

Warwickshire |

|

| Azeem Shaikh |

Montreal |

|

| Aldorn Kaseke |

Cape town |

|

| Haowra |

|

|

| Sahira |

Birmingham |

|

| Houda Bennini |

|

|

| Ozgu Akcakir |

San Diego |

Being silent to the genocideis complicity |

| Lilly |

London |

|

| Zeid AbuOdeh |

|

|

| Mohamad Zeitoun |

Fremont |

Please adhere to humane standards and guidelines, regardless of race, color, ethnicity, religion, or origin. |

| yasser hashem |

|

|

| Shiza Khan |

|

|

| Sohel khan |

Kitchener |

|

| Dr Shohrat |

|

Free Palestine |

| Stacie Weaver |

Hershey, PA |

No organization committed to human rights would fire an employee for advocating for human rights. |

| Caitlin Miller |

London |

|

| Saqib Noor |

|

|

| Mary Sisco |

|

Thank you for having a heart and soul. |

| Natalie Smith |

|

|

| Zakaria Kawsar |

London |

|

| Jennifer |

Phuket |

|

| Manzoor Mustafa Ahmed |

London |

|

| Kirsten Hummel |

Quebec |

|

| Robert Martin |

Dublin |

|

| Zachary Kirkpatrick |

Barcelona |

|

| sean smith |

|

|

| Sammy Mendonca |

London |

|

| Nora Schild |

|

|

| Iman Bugaighis |

Lisbon |

|

| CM Bednarski |

London UK |

|

| Yara Awad |

|

|

| Question? |

New York |

|

| Taina Chahal |

Thunder Bay, Ontario |

|

| Abdel Rahman ELSAYED |

|

This extremely worrying considering Israel’s extensive use of autonomous weapons on Gaza |

| Teresa Smith |

Los Angeles |

|

| Clarence Okoh |

Washington DC |

|

| Helen Black |

Nelson |

|

| Assad Yousef |

|

|

| Vinodha Joly |

Livermore |

Our sense of humanity cannot be selective. We cannot stand silent when war crimes and crimes against humanity are being committed. |

| Daniel York Loh |

London |

|

| Fatima Derbi |

Manchester |

|

| Zoe Vidaly |

London |

|

| Dr. Timnit Gebru |

Palo Alto |

|

| Dilan Manatunga |

Atlanta |

|

| Hiba Arshad |

Toronto |

|

| Katherine Zhou |

Stockholm |

|

| Crystal R Widger |

|

An organization that promotes justice and human rights firing someone for promoting justice and human rights blows my mind. Shame on you for not speaking out against the genocide of the Palestinians and for punishing someone brave enough to do so. |

| A Smith |

|

|

| Kashif |

Glasgow |

|

| Absolutely agree |

Manchester UK |

|

| Anita Kanani |

London |

I am fully in support of this letter and urge that steps are taken as outlined in it |

| Joe Carmel |

|

Wishing you all the best. |

| Peace for Palestine and Israel |

Addis Ababs |

Justice to Ousman Noor! |

| Elisabeth Wolfe |

Ventura CA |

|

| Ellie Harding |

|

Total injustice. The company should stay true to basic ethics. |

| Dr Ammar Waraich |

Birmingham UK |

|

| N. Mansour, United States |

|

Aren’t “killer robots” being used in Gaza in violation of int’l law on a daily basis? Particularly to target civilian individuals (journalists, doctors, scholars & their families) Why would you fire someone who stands for what KR is meant to represent? I find the paradox distressing. |

| Kat Dodds |

Vancouver, BC, Canada |

I think it is unconscionable for an organization like Stop Killer Robots to behave in this way and to not make a statement in oppostition to the Genocide in Gaza. |

| Nathan |

Los Angeles |

|

| Murtiza Taymuree |

Los Angeles |

|

| Rani |

Bangalore |

|

| ANABELA |

|

|

| abby |

|

|

| Farhana Ali |

Manchester |

|

| James |

London |

|

| Ayse Turkmen |

|

|

| Khaldoon Khaireddin |

Los Angeles |

|

| Esra Murad |

Wokingham |

|

| Isabel Avina |

Vallejo |

|

| Amal chehayeb |

|

|

| mara ahmed |

new york |

I urge SKR leadership to address the concerns laid out in this letter. |

| Christian Cmehil-Warn |

Cambridge |

|

| raysting02@gmail.com |

Europe |

|

| Maybelline Ungar |

Florida, USA |

|

| Bob Symonds |

Birmingham UK |

Speaking out about the Palestinian situation is a courageous intervention given the support for Israel from countries in the West and their MSMedia’s. The use of AI weapon systems in this genocidal response to non-combatants is truly sickening and horrific, given the overwhelming military superiority of US/Israeli weaponry and fighting forces. I am therefore surprised Ousman’s employers have removed him from his position, rather than supported his position, given the work he and his employers are engaged in? I trust Ousman’s appeal against dismissal is heard, investigated fully and is successful, in regard to reinstatement, adequate compensation, or both. |

| Mona Baker |

Oslo |

|

| Haroon Malik |

Watford |

|

| Shirin Haider |

Helsinki |

|

| David Cullen |

Oxford, UK |

|

| Frank barry |

Paris |

Stop the genocide in Gaza. |

| Frank Afranji |

Tigard , OR |

|

| Carl Webb |

Austin |

|

| Speaking out against injustice isn’t a crime. |

|

| Hari Ziyad |

Los Angeles |

|

| Ahmed Metwally |

Calgary, Canada |

Please stop prejudice against people who stand against thr ongoing genocide. Otherwise, you are being complicit in it. |

| Sandra Pereira |

Lisbon |

👉 https://elsc.support/

Free Palestine 💪

Equal human rights for all 🫂

Merry Xmas 💫✨️ |

| Marlabetz Figueroa |

Jacksonville |

|

| Barney Carroll |

Reading, UK |

|

| Mehnoor Khaliq |

|

|

| Aini Jelani |

|

|

| John Pawson |

London |

|

| Katrina Browne |

Londonderry NI |

|

| Albert Sabater Coll |

|

|

| Zaynab |

|

|

| Denis Dalton |

|

|

| Karen Bernal |

Sacramento |

|

| Chadapohn Chaosrikul |

Bangkok |

|

| Azeem Khan |

New York |

|

| Orsola Casagrande |

|

|

| Marwa AlGamal |

Alexandria |

|

| S. Motsinger |

Wilmington, NC |

|

| Reena Geevarghese |

NYC |

|

| Faisal |

London |

|

| Hassan Gulraiz |

Toronto |

|

| Timothy Garrison |

Chicago |

Israel is using AI to exponentially increase its capability of targetting civilians. Few equally salient opportunities exist for SKR to actualize its values, yet they chose hypocrisy. |

| Lenina Oliveira |

Geneva |

Ousman has a right to free speech. |

| Nafiul Islam |

Birmingham, AL |

|

| robert rizzuto |

bronx ny |

|

| Waseem k |

Cambridge |

|

| Janine Perlman |

|

As a person of Jewish heritage, like the great majority of the world I abhor the atrocities being visited on Gaza by Israel. It is completely unacceptable that a person who is making a personal statement about obvious crimes against humanity and war crimes should have his employment terminated. The irony that CSKR took this action would be laughable if it weren’t an exemplary employee’s job at stake, lost because he took the right stance on one of the clearest breaches of international law and basic human ethics since WWII. |

| Salof Farabia |

Bucharest |

Given your NGO’s mission, I find it shameful how you dismissed Mr Noor. Instead of standing by him for his opinion which falls in line with your mission statement from what I understood, you proved bigotry and hypocrisy. |

| Faizal Daniels |

Cape Town |

|

| MAQSOOD AHMAD |

Greater Manchester |

|

| Lena Jayyusi |

|

|

| Khalid Bashir |

Birmingham |

|

| Stryker Kelly-Thompson |

Detroit |

|

| Gitika T |

Seattle Washington |

|

| Diego Alcalá Laboy |

Wilmington, DE |

|

| Akram Jahanian |

London |

|

| S D Lulz |

|

|

| Hilal Malawi |

|

|

| Nancy Hammond |

Chicago |

|

| Masab Khan |

Chicago |

|

| Tali Shapiro |

|

|

| P Atkinson |

Texas |

October 7th does not justify the killing of a single innocent soul. |

| Simone |

Glasgow |

|

| A. Joseph Layon, MD |

Gainesville FL |

|

| Rose Altmeyer |

Charlotte |

|

| Iram ahmed |

|

|

| Abdul Raheem |

Calgary |

|

| Muhammad Chaudhry |

Manchester |

|

| Amna |

|

|

| Mark Fleming |

Seattle |

|

| Dr AHMED FAROOK |

BRISTOL |

It’s time we call a spade a spade, and not fear the dust that is kicked up. Injustice, dehumanisation, ane genocide MUST BE STOPPED, whoever the perperator. To hide behind accusations of anti-semitism assumes the crimes form part of the Jewish culture, and nothing can be more unjust against the Jewish religion and the Jewish people. |

| Dylan Nguyen |

Little Rock, Arkansas |

The world is watching. |

| Sharon Beck |

McKinney |

|

| Alexis Preston |

New York |

|

| Lesley Barker |

Mortain |

|

| Nabila |

|

|

| Steve |

Los Angeles |

Stop retaliating against people that want to stop a Genocide. |

| David Eccles |

The Whanganui a Tara |

|

| Umayr Hassan |

Lahore, Pakistan |

|

| Luke Steele |

London |

|

| Elle Uwakwe |

Londo |

|

| Mario Molino |

Palermo, Italy |

|

| Patricia foley |

Naas |

|

| Christopher Kapilla |

Edmonds, WA |

Godspeed |

| Phil Baptiste |

Leeds |

|

| Sasi Tempu |

|

|

| Rune Kongshaug |

Oslo |

|

| Mike Harling |

London UK |

|

| Steven Lucas |

Albany, CA. |

|

| Adan Diba |

Nairobi |

Transparency, justice and accountability to be served to Ousman Noor |

| Ali hachem |

Huntsville |

|

| Abdelrahman |

Dubai |

|

| Constance M Davidson |

Perth, Scotland |

|

| Maria Munir |

|

|

| Ahmed Mohammed |

|

|

| Yasir Hassan |

London |

The arbitrary and unilateral approach taken by the organisation raises serious concerns as to the biases of the leadership, and how deep these biases run? I will be monitoring the outcome of this with interest. |

| Kyla Bowen-la Grange |

London |

|

| Danny Heap |

Toronto |

|

| Gary Lord |

Australia |

|

| connie sanchez |

Adelaide |

|

| Zahir Haque |

Slough |

|

| Sahar Cury |

New York |

|

| Asim |

Toronto |

God be with you. The hypocrisy is incredible. Incase you have any bandwidth or know anyone who does, we’re also trying to attain “1948 letters” to symbolically point to understanding root causes of this colonization. Learn more here: https://islamophobia.io/palestine Keep the faith. @studentAsim |

| Isaac Jones |

|

|

| Amal Al Azzeh |

Geneva – Switzerland |

|

| Misael Mondragon |

Dallas |

|

| Sharon foulds |

Staffordshire |

|

| leila lamarti |

Liège |

|

| Mohammed Naushaduddin |

Sydney |

Keep the good fight going |

| Sonya Pervez |

Preston |

|

| Lauren Councill |

|

|

| Naheem Zafar |

oldham |

|

| Jessica Santos |

New York |

Jessica Santos |

| shankar |

|

|

| Aisha Syed |

Richmond |

|

| Asima Ramzan |

Manchester |

|

| Prakash Diar |

Ottawa |

|

| Mark A |

Washington DC |

Thanks. |

| Beatrice Brown |

Sydney |

It is very disappointing that an organisation that opposes reckless killing via technology sacked a man who opposed reckless killing in his personal life. No company should presume that they own someone’s personal opinions, and the disdainful way the company sacked Ousman does not bode well for its ethics. |

| Isra Yazicioglu |

Wynnewood, PA |

Integrity, justice and transparency: urgent and non-negotiable. Palestinian Lives, too, Matter. |

| Linda Jansen |

Seattle, WA USA |

|

| Joni van der Westhuizen |

Johannesburg South Africa |

Why aren’t you protesting and dismantling the automated and AI weapons being tested on Palestinians |

| Meryem haguiga |

Tunis |

|

| William Barnett |

Swindon |

|

| Amjad Qureshi |

Islamabad |

I m worried about future of humanity |

| solmaz eshraghi |

Toronto |

this is a critical moment for us to amplify voices against genocide |

| Suhailah Akbari |

Berlin |

|

| Krista Kitmitto |

San Diego |

|

| Deb Keys |

|

|

| Nasim ahmad |

Peshawar |

|

| Ian Brokenshire |

Darwin, Australia |

Thank you for your courage and conviction |

| Brian Masterson |

London |

|

| Yahya |

Saudi Arabia |

|

| Mark Gerban |

|

Peaceful dialogue should never be condemned, and this is a violation of Freedom of Speech. Please reinstate. |

| Summiya Khalid |

Toronto |

|

| Asem Alaa |

London |

|

| Shawn |

Africa |

From the river to the sea Palestine will be free |

| Dr Sofiane ABBAR |

London |

|

| Yvonne Davies |

Herefordshire |

|

| Omer Selcuk |

Lonodn |

|

| Abdelrahman Eldesokey |

|

|

| Clare O’Hara |

Dublin |

|

| Pamela Salazar |

Irvine |

|

| Valber Hudson |

Danbury |

|

| John Le Fevre |

Phnom Penh |

Free Palestine, end the genocide |

| Stephanie Wrightson |

Harrogate |

|

| Saira Aly |

Brighton |

Unfairly dismissed not thru lack of performance at work but personal out of work expressions |

| Junaid Kalang |

Preston |

|

| Sophie Ciurlik Rittenbaum |

Norwich |

|

| Rashmi Luther |

Ottawa |

|

| Jessy Jordan |

Berlin, Germany |

|

| Ashley Dalton |

Sydney |

|

| Wlad Tijma |

|

|

| Maureen O’Hara |

London |

|

| Tawfiq Wolff |

Los Angeles |

|

| Silvia |

|

|

| Danish Zahur |

|

|

| Andy Madsen |

Buffalo, Wyoming |

In time, those organizations who worked to silence voices protesting the immoral and illegal ethnic cleansing by the Israeli Government will be held accountable. Please reconsider your actions here and ensure you stand on the right side of history. The Palestinian People deserve our consideration, our support, and to be treated as full citizens of the worldwide community. |

| Fadhma Izri |

Washington, DC |

Silence in the face of injustice is an endorsement of injustice. |

| Shaleece |

Baltimore |

|

| Salah Uddin |

Union |

|

| S. Faraj |

Viola, WI |

|

| Hal Reed |

Philadelphia |

|

| Mohamed Amir Abdelrahman Osman |

Munich |

The silence in the face of injustice is complicity with the oppressor |

| Ali Britton |

|

|

| Germeid Gimborn |

|

|

| Dala Taher |

Montreal |

|

| Rachel |

Sydney |

|

| Vin Tanner |

|

I’m very sorry Stop Killer Robots has discriminated against supporters of Palestine and Palestinians, especially when doing do goes against the supposed goals they claim to have! I wish you all the most luck in resolving such a wrongful termination and total lack of upholding the values of fighting against military technology. |

| Kate Kilner |

|

|

| Junaid |

|

|

| Mohammed hassan |

|

|

| May Hulsman |

Boston |

|

| Amz |

London |

How can a person calling for peace be fired. You people are genocide supporters. |

| Ashraf Khateeb |

Jordan |

|

| Adel K |

|

|

| Isabelle Sykes |

London |

Shocked and deeply disturbed by both the lack of support by Stop Killer Robots for a ceasefire in one of the most horrific of illegal wars, as well as the decision to dismiss Ousman. Doublethink at its worst. |

| Abdel Bagegni |

Reading, UK |

|

| Umar Khan |

Ypsilanti |

|

| John Targett |

Christchurch, U.K |

|

| Richard Patterson |

San Martín de Teverga |

|

| Musa Izhiman |

Jerusalem |

|

| Vivian Kelly |

Galway |

|

| Nathalie Owe |

Geneva- Switzerland |

|

| Nur |

Kampar |

The common people of the world is against the occupation of Israel towards the Palestinian |

| Kirby Evans |

Ottawa, Canada |

When enough people speak up for justice, justice will come! |

| Robert Jereski |

New York |

Good luck. |

| Ton Robinson |

London |

|

| Md Yusuf |

Dublin, Ireland |

|

| Dia Konate |

|

Shame on SKR for firing an employee whose position is truer to the organization’s mission than whatever it is SKR’s leadership is doing. |

| Susan Saberi |

Toronto |

Humanity is one, when one is in pain and suffers all humanity is in pain and suffers. |

| Emily Borg |

|

|

| Waseem H. |

Winnipeg, MB |

|

| Felipe de Castro Andrade |

Ilha Solteira – SP – Brazil |

|

| Aysha |

Toronto |

|

| Abdullah Al Hussain |

Dagenham |

|

| Dannon Ivey |

|

Please consider the Gospel targeting system adn the considerations of AI targeting in this matter |

| Renee Rappard |

Lanigan |

|

| Emma A |

London |

The firing and silencing of people denouncing the bombing of Gaza is undemocratic and politically dangerous. Ousman Noor is entitled to side with the oppressed and oppose the genocide or ethnic cleansing taking place in Gaza and the Occupied West Bank |

| Jeena Malik |

|

|

| Liz Mednick |

|

|

| Joana Pereira |

France |

#freepalestine |

| Raquel Lainde |

Madrid |

|

| Rabia Anwar |

Manchester |

|

| Roman Sanders |

|

|

| Isak |

|

|

| Betina Gnisci |

Buenos Aires |

|

| Benli |

Weiterstadt |

|

| Louai Eleslamboly |

Cairo |

|

| Tarik Aougab |

Philadelphia |

As a mathematician and a member of the Just Mathematics Collective (see our BDS campaign statement here: https://www.justmathematicscollective.net/USACBI_statement.html) I am disturbed to hear that an organization which commits itself to disarmament has failed to make even a passing statement in support of the victims of an unprecedentedly large bombing campaign. Truly, what is the purpose of a campaign such as this if it’s unable to speak up now? |

| Muhammad |

Sleman |

|

| Myra Khan |

|

|

| Adek |

Tripoli |

|

| Francis Andtes |

Calgary |

This is Not A political issue. It is a morale, humanitarian issue |

| Rachel Jespersen |

|

|

| Roohi Qureshi |

Toronto |

|

| Mohammad S |

|

|

| Carole grbin |

Glasgow |

|

| Hamzah Awad Hajeir |

|

|

| Miriam Yilmaz |

Neuss Germany |

|

| Mo |

Toronto |

|

| Saeed Ghanim |

Manchester |

|

| Nathaniel Pennington |

Manchester |

All the best 👊🏽 |

| Ubaldo A Laredo |

Ecatepec, Mexico |

Ceasefire NOW in Palestine |

| natalie potter |

STOCKTON-ON-TEES |

|

| Marya Ahmed |

|

|

| Jane Ireland |

London |

|

| Rob Sawers |

Washington D.C. |

I stand with Ousman Noor. He is a committed advocate for those suffering from oppression and violence by killer robots and that includes the Palestinian people. Stop Killer Robots should be congratulating him, not firing him, for his statements on the violence against Palestinians in Gaza. |

| Talha Faredi |

|

|

| Rochelle Harris |

|

|

| Rashda |

|

|

| Razina akhtar |

Birmingham |

|

| Amber W |

Los Angeles |

|

| Simon Gulliver |

Hove |

|

| Hamzah Nassif |

Toronto |

SKR should restore the public’s trust in its mission by reinstating Noor and issuing a statement condemning Israel’s assault on Gaza, calling on it to refrain from unethical use of AI systems to target Palestinian civilians, and to call for an immediate ceasefire. |

| Anwar |

London |

|

| Quinesha McMath |

Enterprise |

|

| Diane McLoughlin |

|

|

| Anna |

Hamilton, ON, Canada |

|

| Saif M |

Montreal |

|

| Terry ahwal |

Farmington Hills |

Best wishes! |

| Lisa Ling |

San Francisco Bay Area |

Supporting human rights or IHL is not only a matter of convenience or only if and when politically safe, in my opinion it is an actual binary. Either one person or organization supports human rights across the board, or they do not support human rights. Either one supports IHL across the board or they do not support IHL. For these critical issues there can be no fence to sit on. |

| Jo Murphy |

Dublin |

|

| Rashid Ahmed |

London |

All communication to be via email,.not SMS or calls. |

| Arfan Amaluddin, concerned citizen |

Bangi, Selangor, Malaysia |

|

| Jay Ali |

London |

|

| Mohsin |

|

|

| Jumana Saleh |

London |

|

| Sammy Miah |

|

|

| Ezio cusi |

Shawnigan lake |

|

| Sabrina Volpi |

Rome |

|

| Ali Shakur |

Chicago |

|

| Paula Muth |

Aquebogue |

|

| Naim Uddin |

|

|

| Sami Adurehman |

London |

|

| Melinda Sanders |

Atlanta |

Ceasefire now!! |

| Husam Elsheikh |

Leesburg |

|

| Dina Sorour |

|

Calling out genocide should be supported, not punished |

| Buhle Maseko-MacArthur |

Cape Town |

|

| Samar Hadrous |

Corona, California |

|

| Robert |

Islip NY |

Hold Israel accountable for war crimes and crimes against humanity. |

| Nikhil Dharmaraj |

Cambridge |

|

| Zhimei Zhu |

|

|

| Julie Houston |

Glasgow |

|

| Annie McNamara |

Whitstable |

|

| Ali Aziri |

|

|

| Elias Madbak |

|

|

| Daniel Vargas |

Mexico City |

Free Palestine |

| Ramid Khan |

|

The plight of the Palestinians is a stain on humanity and has been for decades. Even more of a tragedy is the suppression of voices which want an end to the suffering of the Palestinians. |

| Asghar |

Toronto |

|

| Joe Chang |

Toronto |

|

| Sarwat Ahmad |

Plainfield |

|

| AbdulHafeez S. |

|

|

| Hajid Hassan |

Muscat |

|

| MK Woodward |

|

|

| Wally Waliullah |

Los Angeles |

|

| Sadia Saaher |

Toronto |

Please, do not punish people for speaking the truth and standing with the oppressed. |

| Belinda A |

Melbourne |

|

| Alshimaa Mostafa |

Kyoto |

Stop this systematic racism against people who are brave enough to say the truth |

| Adil Jadoon |

Boulder |

|

| Rashid Haq |

London |

|

| Jeanette Anderson |

Canberra |

|

| Ghias El Yafi |

London |

Good luck |

| Pablo |

Augsburg |

|

| Sasha Baker |

St Albans |

|

| danielle |

Rio de Janeiro |

|

| Cherie Austin |

|

|

| Ahmed Arafa |

Osaka |

|

| Heather Brescia |

Lacrosse, WI |

Speaking out on genocide is a moral obligation. No matter the cost, thank you for your humanity. |

| Salman Naqvi |

Toronto |

Wow, it’s insanely ironic that an organization dedicated against the use of lethal AI dismissed someone who spoke up against Israeli army, who’s actively using lethal AI!!!! How ridiculous is that?!!! Stop Killer Robots , you got explaining to do! Please sign, share and urge others to sign! |

| Salma Fawzi |

Tokyo |

|

| Rami A |

London England |

|

| Muhammad |

Melbourne |

|

| Omima |

Parkville |

|

| Linda Sarihan |

Christchurch, New Zealand |

|

| Sajah Hammoud |

Sydney |

|

| Alison Johnson |

San Francisco |

|

| Fauzia |

Islamabad |

|

| muberra sahin |

McKinney |

|

| Ciara Walker |

Staten Island NY |

|

| Sohad Jamal |

Danbury |

|

| Bonita Archer |

|

|

| Jacob Lester |

|

|

| Fahad |

|

|

| Rick McCallion |

St Catharines |

Israel IS a killer robot.

“Anne And Joe Argue About The Child-Killing Murder Robot” by Caitlin Johnstone

https://www.caitlinjohnst.one/p/anne-and-joe-argue-about-the-child?utm_source=profile&utm_medium=reader2 |

| Andrew James |

|

|

| Zara Chaudhry |

|

|

| Lucy |

Seattle |

|

| Naseem |

Ottawa |

|

| Ali Khwaja |

Toronto |

|

| Shahid Siddiqui |

|

|

| Mustafa Meghjee |

London |

|

| Jean McDerbmott |

Burnaby BC |

|

| Rehan Ashraf |

London, United Kingdom |

|

| Hasan Rahman |

Canada |

|

| Constanza Riderelli |

|

God bless you |

| Ruhana ali |

London |

|

| Don Cooper |

Toronto, Ontario |

|

| Dhananjay Patil |

Mumbai |

I support Ousman Noor’s Appeal For remedies against unfair dismissal. Israel has been using AI & other advanced technologies in perpetrating this Genocide in Gaza. Osman Noor’s dismissal from ‘Stop Killer Robots’ for personal post meant to draw attention towards atrocities in Gaza is very antithesis of cause SKR claims to espouse.

“Reinstate Osman Noor & investigate who & why took decision to fire him im such highhanded manner! “. |

| Elizabeth Engel |

|

|

| Shahin |

India |

|

| Munazza Anwar |

Karachi |

Plz provide justice to Ousman Noor and stop atrocities and child killing in Gaza. Provide relief to the innocent victims of Gaza |

| Shihab Ahamed Abdul Hameed |

Sydney |

|

| Louise van Rhyn |

Cape Town |

|

| Dr Fatima |

Pakistan |

Stop censuring Pro Palestinians people, promoting their mass murder ! |

| Naima Imaan |

Rabat |

No to any HR violation. Stop the discrimination and oppression! |

| Hala Aldosari |

Washington DC |

|

| Jonathan Lu |

Palo Alto, CA |

|

| Ron Jetty |

Madison |

|

| Assim Kamuka |

London |

|

| mehmet |

kahramanmaraş |

|

| Iftikhar Mahmood |

Aurora |

|

| Saad Sayed |

Mumbai |

|

| Rehman |

Bangalore |

|

| Anna-Luisa Brakman |

|

|

| Andreas G. Flober |

Siem Reap |

Free Palestine. I am not an Antisemite. |

| Susan Smith |

Woodland Hills |

|

| mohamed ebrahim |

|

|

| Nicola Banks |

London, UK |

|

| Mohsen Javdani |

Vancouver |

|

| Sajjad shoabe |

South Windsor |

|

| Farah |

Kuala Lumpur |

|

| Nouhad Aoukar |

|

|

| Salim Salim |

Montreal |

From the river to the sea, everyone should be free |

| Melissa Finn |

Waterloo, ON, Canada |

|

| Nadeem Khan |

Mumbai, India |

Stop injustice on the basis of religion, race, ethnicity or gender. |

| Hasna Alaoui |

Auckland |

|

| Chance Beretta |

Jacksonville |

Israel is committing genocide and war crimes against Palestinians and all of Gaza where 50% of the population are children, i am a white American, and do not have a dog in this fight, but I am not too blind to see truth and through the Israeli lies and propaganda. God bless the children and the people of Palestine. |

| Hanane Boubakra |

|

|

| Nizar Sarieldin |

Berlin |

|

| Rayya Ghul |

Edinburgh |

The return McCarthyism is one of the most disturbing aspects of the past two months, let alone disregard for free speech. SKR has discredited itself with this summary dismissal and risked appearing partisan. |

| Marta Joaquim |

|

|

| Andrew Simmonds |

Hereford |

|

| Annie siddons |

London |

|

| Scott Johnston |

Winnipeg, Manitoba. Canada |

|

| Muntasir Joarder |

Brisbane |

|

| Adnan Shaikh |

Auckland |

|

| Mario Foster |

|

|

| Sumreen |

Winnipeg |

|

| Husam Abuhaimed |

|

|

| Rene Buxh |

Dussseldorf |

|

| Iman Jilani |

San Diego |

|

| Ori Blum |

|

Anti-Zionist Jew descendant from survivors of the Nazi death camps, and son of “Israelis” who emigrated to “America.” Let me know if you think I may be able to assist somehow. Happy to talk. Free Palestine🇵🇸 |

| Ian Heath |

Brisbane, Australia |

Cease fire now |

| Ayman Fahmy |

|

Injustice to One, is injustice to All |

| Mohamady El-Gaby |

|

|

| Sophia Adam |

Scotland |

|

| Siân Finn |

Birmingham |

|

| Sarah Brazil |

Geneva |

|

| Keith Watson |

|

|

| Thomas Williams |

Manchester UK |

|

| Thoric Cederström |

Geneva, Switzerland |

|

| Eric |

Wellington |

|

| Zeinab Benchakroun |

San Rafael |

|

| roxi charmel |

Allentown |

|

| Aslam |

|

Palestine will be free |

| Brett Leeper |

Springfield |

If the use of killer robots to commit genocide and war crimes isn’t topical to the mission of Stop Killer Robots, what are y’all even doing? And why should y’all expect to fundraise ever? |

| Abby Whorton |

Costa Mesa |

|

| Siva Prasad Rambhatla |

Hyderabad |

|

| Zaid Habashneh |

Amman |

|

| Omar |

|

|

| Rachel Luxton |

|

|

| Darran Scully |

Reading |

|

| Sabina |

Leicester UK |

|

| Pat Matsueda |

Honolulu |

|

| Nura sheer |

|

|

| Aasif Rasul |

Bangalore |

|

| Courtney Evers |

|

You should be ashamed of yourselves. What kind of organization like this spits in the face of an actual genocide and emergency? They are using advanced weapons of war on a defenseless population. You all need to reevaluate what it is you are actually doing! |

| Jim Pinckney |

Auckland |

|

| N Iqbal |

Birmingham |

|

| Payal Parekh |

|

I too wrote an article in German about Palestine and lost a major contract. Now I am reduced to doing menial work to pay my bills; Solidarity and peace to you. How such a campaign can fire you for pointing out human rights abuses is beyond me. It makes me question the whole campaign. |

| Aaishah A |

Sheffield |

Thank you for your sincere support Ousman for standing up to injustice- this is scandalous and unfair – you have my support – we will not be silenced amidst genocide wherever it happens. |

| Latifa |

Brasschaat |

|

| Mansur Mahmud |

London |

|

| Wissal Abdallah |

|

|

| Amina Fajjia |

Antwerp |

|

| Hend |

Gaza |

Solidarity and more power to you |

| Achiri |

Nicosia |

|

| Nusrat |

|

|

| Monica Perez |

Switzerland |

AI in warfare should be forbidden and a war crime since it’s so unrreliable. |

| Amjad Ghafoor |

London |

Give him his job back!!!! |

| Saifullah Taj |

London |

A world where injustice runs rampant is not acceptable. Everyone must mobilise to establish truth & justice. Corrupt elements must not be allowed to hold sway or parade their small ideas. They must be pushed to the margins of society. God has already guaranteed that truth will prevail. We just need to make a stand & take that first step. God is the guarantor that the criminals of this world will not get away. |

| Sahrish Ahmad |

Auckland |

|

| Laurence Meyer |

|

|

| Axel Brammeier |

Stendal, Germany |

|

| Javed Butt |

Dresden |

|

| Dr. Manzoor Nowshari |

Germany |

Nein |

| Jemaï Alissa |

Lyon |

|

| Bernadette Barton |

Manchester |

|

| Daisy Garcia |

|

|

| Patricia Nolan |

For Augustus |

|

| Bashir Sacranie |

London |

Resistance to the attack on Gaza and Palestine ls an obligatory act upon every human being in the interest of justice and sirvival |

| Kashif Naseem |

Greater Noida |

Stay Strong Brother |

| Dilshad Marikar |

bury st edmunds |

|

| Jon Aresti |

|

|

| Natasha B |

Cambridge |

Never tire of speaking up for justice. |

| Aminat Amoo |

London |

|

| Shazia Siddiqi |

Chicago |

|

| Amr Khafagy |

|

|

| Lucian Fiul |

New York |

|

| Budhy Manegara |

Helsinki |

|

| Tahir Shah |

London |

|

| Ahmed Banat |

London |

|

| Ahmed Abusamra |

|

|

| Mary Henderson |

Edinburgh |

|

| Kashif Choudhry |

Paris |

|

| Theo Green |

|

|

| Iqa Zuhdi |

Amsterdam |

|

| Ahmed Saleh |

Amsterdam |

lets Free Palestine together |

| Dr Jaafar El-Murad |

London, England |

|

| Yusuf Motara |

Makhanda |

|

| Ramzi Elkhater |

San Diego |

|

| Taaseen Rahman |

London |

|

| Kashifa Aslam |

Melbourne |

|

| Maryam Iqbal |

Copenhagen |

|

| Oktavia Arief |

Jakarta |

|

| Mahmoud Aref |

Cairo |

|

| Damon Minchella |

Cardiff |

|

| Furkan Çay |

|

|

| Abdulmalik Abdulrahman |

Roseville |

|

| Suleman Anwari |

|

a ceasefire now to stop this genocide |

| Martin Franklin |

London |

|

| Erich Friesen |

Saint Louis, Missouri |

|

| Ehtesham Siddiqui |

Mumbai |

|

| Roy Bly |

Sheffield UK |

|

| Remmelt Ellen |

Amsterdam |

|

| Em Tan |

Turkey |

|

| Ahmad Sodikov |

Birmingham |

|

| Ismail murky |

|

|

| Carmen Martins |

Portugal |

|

| Lisa Martínez |

London |

|

| Atha |

|

|

| Saira Court |

Christchurch |

|

| Elisabeth Wynne |

Walpole |

|

| Donovan |

Chicago |

|

| Daphne Hunter |

London |

|

| Jakir H |

London |

|

| Laura Guerra |

Austin |

|

| Xavi Portalés |

Castelló |

|

| Councillor Sabia Akram |

Slough |

It’s beyond comprehension that an organisation designed to raise awareness, impartial and fighting for fairness. Can be so biased and inept at meeting it’s own fundamental purpose and objective. The world is now truly a scary place. |

| Kiran Chudasama |

Leicester |

|

| Faour Alfaour |

Dublin |

Peace for all |

| Ayesha M. Alli |

Toronto |

|

| Dania koleilat Khatib |

Dubai |

|

| Rihab Hermessi |

Haarlem |

|

| Cherry Barnett |

|

|

| Silvana Molina |

Washington DC |

|

| Melissa Carranza |

Milwaukee |

Thank you for standing up against bought & US paid for propaganda by Israel & AIPEC. The True side of the story needs to be shown to the world. |

| Wasef El-Kharouf |

|

|

| Kevin Flanagan |

Hartford |

|

| Anasa Sinegal |

|

|

| Muhammet Celik |

Munich |

|

| Igor Cherstich |

|

|

| Ali Mehdi |

Sydney |

|

| Irene Sotiropoulou |

Ormskirk |

|

| Imad |

Seattle, Washington |

|

| Riz Iqbal |

Manchester |

|

| Nassim Fathallah |

Montreal |

|

| Ceyhan Sarac |

MANCHESTER / UNITED KINGDOM |

It is shame the organisations such as Stop Killers Robots staying silent on obvious violations of human rights and massacred Gazan families and children!

I also it is very ironic that when one of their employee Ousman Noor acted to protest against these human rights violations even if on his personal capacity he was punished by dismissal from his post.

Finally, I condemn…employer Stop Killers Robots for their deplorable act! |

| Hamid Biglou |

|

|

| natasha shoaib |

KL |

|

| Yusuf Mohammed Yahaya |

Kano, Nigeria |

God bless you |

| Dr. Ruth San Martin |

Toronto |

I think what this organization has done is reprehensible. |

| Madeeha Ansari |

|

|

| Corina Gurau |

London |

|

| Ali Torabi |

Stockholm |

|

| Iffat |

Multan |

|

| Lamia Touiti Bouebdellah |

Gabes – Tunisia |

|

| Omar Hijaz |

Boston |

|

| Yara Awad |

|

|

| Gila Kaplan |

Denver |

Palestinians are Semites too. Stop Anti-Semitism. Stop complicity with genocide and with the Zionist project. |

| Ilse Cardoen |

Ninove |

|

| John fowler |

Austin |

|

| Faisal Khan |

|

|

| Pierce Sharelove |

Victoria BC |

|

| Ann Newton-Marcial |

Eastbourne |

This is disgraceful but indicative of the situation where support for Palestinians often results in the loss of employment. This situation has to stop and support for people who support the oppressed is seen as being on the right side of history. We should never support a system of Apartheid or those who murder and are complicit in a Genocide. |

| Dima Balbisi |

Oakville |

|

| Rafidah Abdul Hamid |

Kuala Lumpur, Malaysia |

|

| Benedetta de Niederhäusern |

Modena |

|

| Anya-Nicola Darr |

Exmouth |

|

| Lila Lamrani |

Paris |

|

| Mohamed Ismail |

Johannesburg |

The truth will set you free #freepalestine |

| Quraysha ismail sooliman |

PRETORIA |

|

| John Robb |

Ayr |

|

| Budi Witjaksono |

Batam Indonesia |

|

| Rania Elessawi |

New York |

We all need to speak the truth, history is not subjective. There are only facts. |

| Susan |

London |

|

| Natasha |

Toronto |

|

| Rania khas |

Jordan |

|

| Glen Harnish |

Boston, MA |

|

| Yasser |

Hämeenlinna |

|

| Rya West |

Torquay |

|

| Lina |

Paris |

|

| Ahmad Jamal El-Ahmad |

Beirut |

|

| O. H. Arman |

|

|

| David McGarry |

Liverpool |

|

| Leila Tarighi |

Cambridge |

|

| Alia ElKattan |

New York, NY, USA |

|

| Cody Dolnick |

Joshua Tree |

|

| Huma Dar |

|

|

| Sarah H |

New York |

|

| Pia Singh |

|

|

| Dr. Daina Romeo |

|

|

| Barbara Myer |

|

|

| Kudzai |

New Jersey |

|

| Shoaib Rasib |

Birmingham UK |

|

| Shewit Zerai |

Los Angeles |

|

| Nausheen iqbal |

|

|

| Ruhana Pimenta Lima |

Cambridge |

|

| Ali Shehper |

|

|

| Fatima Hassan |

London |

|

| Gulsum |

Amsterdam |

|

| Eric Dynamic |

Ypsilanti, MI |

|

| Lizzie Eldridge |

Glasgow |

|

| Michelle Staton |

Belle Mead, NJ |

|

| Jeanine Abuahmad |

|

|

| carolyn weaver |

new york |

|

| Salman Waheeduddin |

Franklin |

|

| Atif Mohammed |

Toronro |

|

| Noah Rahman |

|

|

| Dr. Hassan Karim |

Dallas, TX |

The mission of SKR aligns with Ousman’s statements. It is appalling that SKR would capitulate to its detractors demands. |

| Yeiri Robert |

Bronx |

|

| Anne Hansen |

Stavanger |

|

| Sarah Dwidar |

Geneva |

|

| Tony Saleh |

London |

|

| Sara branco |

|

|

| Nour Eddine BENCHEIKH |

|

I support freedom of speech and freedom of thought |

| Umara Chaudhry |

|

|

| Ali Malik |

|

|

| Amir |

Seattle |

|

| Mitzi Austero |

Manila, Philippines |

|

| Ramiza@mmlegal.co.uk |

Glasgow |

|

| Mauricio Dominguez |

Amsterdam |

|

| Samira |

Londerzeel |

Stop the long arm of Zionists in politics, finance and humanitarian world |

| Tasawar Awan |

Reading |

Na |

| Iman Abdullah |

London |

|

| Zille E |

|

|

| Michaela Wik |

|

Israel in front of Hague! |

| Petra Schuster |

GERMANY |

|

| Jorge |

Quito |

|

| Brynn J Morrison |

Sharjah, UAE |

|

| Gabriela Siegel |

|

|

| Patricia J Fontes |

Hopkinton RI USA |

|

| Jade Bartlett |

Coventry |

|

| Nina Bartlett |

Boston, Massachusetts |

|

| Banu Turan |

Karlsruhe Germany |

|

| Kana |

Paris |

STAY STRONG |

| Jennifer Armento |

|

|

| Esma Aslam |

Bedford |

|

| Rebecca Ruth Gould |

Bristol, UK |

|

| Sofia Hassan |

Milton Keynes |

|

| Ezgi Yıldız |

|

|

| Rama |

Oakville |

|

| Rachel Fleming |

Edinburgh |

Terrible decisions by SKR – both on the termination of Ousman’s employment without due process, and the silence on the international crimes being committed in Gaza. SKR risks seriously undermining its own credibility. |

| Sara Sarwar |

London, UK |

The world is awaken. |

| Morgan Drew |

Sydney |

I wish you all the best |

| Sajid Butt |

|

|

| Talha |

|

|

| Gene Moy |

|

|

| Abdalla Osman |

Minneapolis |

|

| Ana Brandusescu |

Montreal |

|

| Jonathan John |

Geneva |

|

| imene Ghernati |

Burlingame |

|

| Thomas Bassey |

|

|

| Arcade Wise |

Atlanta, GA, USA |

|

| Nathanael Gerber |

Toronto |

|

| Anass Koudiss |

New York City |

|

| Maria Cipollone, PhD |

Rehoboth Beach, DE |

|

| Ross Miglin |

New York |

|

| J. Carlos Lara |

Santiago |

|

| Simon Landry, PhD |

|

|

| Subho Majumdar |

|

|

| Hakim Benichou |

|

|

| David Heeg |

Arlington WA |

|

| Khurram Zaidi |

New Brunswick |

|

| Shamama Khalid |

Toronto |

|

| Benedicte Frostad |

Oslo |

|

| Obaid Abdi |

Amsterdam |

|

| Sinead Almole |

Newry |

|

| Darshan Sanghrajka |

Oxford |

|

| Taylor Crain |

|

|

| Safaa charafi |

Gent |

I’ve been fired too so good luck! It’s a badge of honour! |

| Faith Addicott |

Portland, OR |

|

| Laura Oliveira Pereira |

Brasilia, Brazil |

|

| Audrey Walstrom |

Denver |

|

| Randall Newnham |

Eugene |

|

| Layla Solatan |

San Francisco |

|

| Amir Nathoo |

|

|

| Linda Ruiz |

San Diego |

|

| Nikita Ramsey |

Detroit |

|

| Nabeel |

|

|

| Gabriel pinna Feliciano |

São Paulo |

Na |

| Lisa Hayles |

|

|

| Sinet Mohammed |

Redmond |

|

| Lina Abdulrhman |

Washington, DC |

|

| Fennel Aurora |

France |

|

| Dominik Miketa |

Oxford |

|

| Kay Johnson |

|

|

| Halima Sadia |

Birmingham |

|

| Mohammad Keyhani |

Calgary |

|

| Faridha Karim |

|

|

| Leslie Zhang |

Seattle |

|

| Vivek Katial |

Melbourne |

|

| Siara Nazir |

San Francisco |

|

| Rochelle Harris |

Aberdeen |

|

| Imran Malik |

Bolton |

|

| Madhu Rama |

Washington DC |

|

| Mena Kuchi |

Oakland, Ca |

|

| Andrew Salib |

Melbourne, Australia |

|

| Toni Oberto |

|

|

| Tahereh Hosseini |

Canada |

Thank you for your support of innocents and oppressed. Please update us on linkedin |

| Sangita Ekka |

SAMBALPUR, India |

|

| Hussain Masood |

|

|

| Muhammad Khurram |

Karachi |

|

| Manal Siddiqui |

Toronto |

|

| Nick Russell |

Irvine, CA |

|

| Gabrielle Hibbert |

|

|

| Isaac D. Tucker-Rasbury |

Los Angeles |

|

| Cristóbal Rodríguez |

Santiago |

|

| Nader A Allan |

Mason |

|

| Dilber Nurdinova |

London |

|

| Ra’ed Arab |

Canada |

|

| Douha Ead |

Atlanta |

|

| Jean-Christophe Helary |

Takamatsu (Japan) |

What you are doing is right. |

| Moe Hay Kaung |

Sunnyvale |

|

| Ali Alwahaibi |

New york |

|

| Neige Gaudillat |

Amsterdam |

Once again these kind of organizations demonstrate their only concern is for hypothetical harm to whiteness. When their very founding purpose is in effect, now, against millions of people, they turn a blind eye because those people are not « worthy ». Shame. Shame. |

| Anusia |

Dublin |

Amnesty has declared Israel an apartheid state. Any organisations or individuals that support Israel’s aggressions in Palestine are indirectly or in some cases directly complicit in apartheid. Palestinians are being denied their human rights, they are being slaughtered, men, women and children. Never again then, not one day more now. |

| Dr. Raazesh Sainudiin, PhD & Docent |

Uppsala, Sweden |

Freedom of expression is an inalienable human right |

| Gokul |

Bangalore |

|

| Rory Donaghy |

LONDONDERRY |

Renstae this man now. |

| Amisha |

|

|

| Heemah Ade |

Abha |

|

| Ebru Goek |

|

|

| Kayra Hopkins |

|

|

| Rara Reines |

London |

|

| Mark Sta Ana |

Norwich |

|

| David Hardman |

London (UK) |

|

| Alessandro Ferretti |

Torino |

|

| Yehiya Sinwar |

Gaza |

|

| Meron Estefanos |

Stockholm, Sweden |

|

| Tony Montreal |

Dortmund |

Justice for all humanity |

| Raymond Forbes-Schieche |

San Juan |

|

| Megan Moore |

|

|

| Amal |

|

|

| Peter Colban |

Berlin |

|

| Harpreet singh |

|

|

| Elizabeth Ehrenzeller |

West Pittston |

|

| Ash |

|

|

| Kristin Bigras |

|

|

| Abdellah Boufroura |

Calgary |

|

| Akiko Oguchi |

Japan |

|

| Erin Doolittle |

Manchester |

|

| Tracey Gyateng |

London |

I genuinely hope the actions that have been outlined in this message are taken forward by SKR. Keep up the pressure |

| Alexandra Carson |

|

|

| Beckett Edwards |

Portland, OR |

|

| Yasmin ahmed |

Stoke-on-Trent |

|

| Pete Kronowitt |

San Francisco |

|

| Cláudia Soares |

|

|

| Roy Wenborne |

London |

|

| Sarah henderson |

|

|

| Lamisa Rahman |

|

|

| Shakirah Muhammad |

Atlanta |

Justice for the babies, for the mothers, for the children, for the brothers, fathers, grandparents, aunts and uncles, animals, and HUMANS stuck in the middle of a political and economical struggle. Free the Palestinian people today and forever. |

| Maritza García Castro |

PR |

|

| Steve Wright |

Oakland |

|

| Heru |

|

|

| Emenike Godfreey-Igwe |

|

|

| Shah Bas Khan |

|

|

| Ayesha Bagus |

Cape Town |

As a South African, I stand firmly against the apartheid laws and ethnic cleansing of the people of Palestine. |

| Nicole Elmasry |

Lady lake, Fl |

|

| Ben Samuel |

London |

I worked with Ousman as campaigners in London and am saddened at what happened. I have looked at the tweet and I don’t see anything wrong with it. I would encourage you to speak with your union representatives if you experience this sort of treatment in the workplace. |

| Aynur B |

Australia |

|

| Rasmus Münster |

|

Free Palestine! |

| Helen Evans |

Sydney |

I have been following Osman’s story. It’s a disgraceful conflict of interest that SKR steering committee have placed themselves in, it undermines their credibility and public trust in their work. Shame. |

| M A M |

|

Accountability and Transparency, minimum |

| Sulvun Surndhu |

Singapore |

|

| Amna |

|

|

| Tufail Hussain |

Birmingham |

|

| Yousra Rahmouni |

|

|

| Judith Muse |

Lunenburg MA |

|

| Saliha |

İstanbul |

|

| Dr. Amir Ameri |

Zurich |

|

| Petter Wildhagen |

Oslo |

Thanks for sharing!! |

| Lea Sarabwe |

Kigali |

|

| Meredith Whittaker |

New York City |

As someone who risked my career to speak out against the development and deployment of AI-powered surveillance and targeting systems at Google, and who is now watching similar systems being used in Gaza–which according to investigative reporting are being applied to authorize and expedite unprecedented killing–I am greatly saddened by the actions of Stop Killer Robots. Firing Noor undermines the the purpose and integrity of the Stop Killer Robots organization and campaign, which is heartbreaking given that now, as such systems are being deployed to horrifying effects, is the time where we need such organizing and expert resistance the most. |

| Thu Nghiem |

Calgary Canada |

|

| Benjamin Harbakk |

Stavanger |

|

| Hamdy Mubarak |

Benicia, California. |

|

| Renee Sieber |

Montreal |

|

| Yasmin A |

Fishers, IN |

This is great injustice that someone being fired for exercising their free speech in America! We do not live and work in a Banana Republic. Shame on SKR |

| Yomna Salem |

Toronto |

|

| Mark Gubrud |

|

The military campaign mindset is not appropriate for an organization that claims to represent the interests of all humanity. Transparency and acceptance of input are needed. |

| Dalia Salem |

|

|

| Samantha Andrel |

Philadelphia, PA |

|

| Iman Saleh |

|

|

| Sara O’Connell |

El Cerrito |

|

| Fida Taher |

Amman |

|

| Ali Raza Ahmed |

London |

|

| Yasar Hammoudeh |

Amman |

|

| Jalil allabadi |

Amman |

|

| Husni Khuffash |

Toronto |

|

| Dima Obeidat |

Amman |

|

| Jane |

Rohnert park |

|

| Mich W |

Brighton |

Look fw to an explanation! |

| Naila Farouky |

|

Stop silencing voices that speak in support of Palestinian rights and be on the right side of history for the love of God! |

| Alice Waterman-Hale |

Ipswich |

|

| Carol |

Amman |

|

| Ahmad Abu-Shaqra |

Hannover, Germany |

|

| Sadaf |

Pleasanton |

|

| Nisreen Mousa |

Amman, Jordan |

Free Palestine! |

| Jiyan Al Alami |

Jordan |

|

| Tahseen Adeeb |

San Jose |

None |

| Samar Dudin |

Amman Jordan |

Power to you and to anyone who speaks on behalf of Palestine your courage is what makes the world a better place 🙏 please you can reach out to Lamees Al Deek a lawyer based in US or to legal aid for Palestine for support . |

| Nada taher |

Jordan |

Justice now |

| Mimi Ana |

Santa Clara |

|

| Pathma |

Oakland |

|

| Mike Sanford |

Santa Clara |

|

| Abdullah Al Nsour |

Al Salt |

|

| Yasmin |

San Jose |

|

| Hind |

|

|

| Jindu Obiofuma, Esq. |

|

|

| Ruweida shakhshir |

|

|

| Hanan shahin |

Amman, jordan |

|

| Sima kanaan |

Amman |

|

| Omo |

|

|

| Takeshi Fukuda |

Tokyo, Japan |

|

| Mayce El Kharouf |

|

|

| Umar Farooq Adam |

Kuala Lumpur |

Rehire Ousman and Free Palestine |

| Umar |

Mumbai |

We need peaceful life for everyone & Palestinian has the right to live in free world.

State of Palestine should be created for peaceful existence of three oldest faith. |

| Masaki Inaba |

Tokyo |

|

| Sara Masafi |

Dubai |

|

| Monica Perez |

Basel |

|

| Dr Zaina Gadema |

|

|

| Ayman Ayad |

|

|

| Kitabayashi Takehiko |

Hachiouji city,Tokyo |

|

| Mai Arai |

Bangkok |

|

| Maha Zabaneh |

Toronto |

|

| Yasmin F |

|

|

| Tom Hickey |

Brighton, UK |

This outrageously unfair dismissal, and absence of due process, is yet another brick in the wall of silence over Israeli atrocities that governments and corporate entities are attempting to erect. The latter will fail, and Israel’s impunity will be challenged. |

| Anand |

Utrecht |

|

| Moh Haider |

Milton Keynes |

|

| Jamari Mohtar |

|

|

| Salim khanfar |

Jordan |

|

| Frances Brace |

Ipswich |

|

| Shahad AlSoudi |

Amman |

|

| Amani Abu Hilal |

Amman, Jordan |

|

| Huzaifa |

|

|

| Subramanian Tiruchirapalli |

Pleasanton |

Peace should be the focus and not war |

| Tamlyn Monson |

Folkestone |

|

| Sahar Ansari |

Milano |

|

| Mohammad Al Taher |

Milano |

|

| Issam Alzinati |

|

|

| Kay Johnson |

|

|

| Mina Chuong |

San Diego |

|

| Rebecca Williams |

New York City |

|

| Duong Hoang |

|

|

| Takayuki Kodera |

Machida |

|

| Homam Al Ansari |

|

|

| Aref M.Y. |

|

|

| Walid Shihabi |

Dubai |

|

| Areej Mahmoud |

Amman |

|

| Maysaa |

|

|

| Rama Cont |

Oxford |

|

| Eisuke Naramoto |

Sagamihara, Japan |

I do not think that condemning the ongoing genoside in Gaza by the IDF is blameworthy, at all. |

| Ayah |

Doha |

|

| Ehab Abdullah |

Milwaukee wi |

|

| Cathy B Glenn |

|

|

| Mireia Rimbau |

|

|

| Hosian Kaldine |

|

|

| Scott Gruber |

Arlington, VA |

|

| Ahmad Rushdi Omar |

dungun |

|

| Fadlun bte hj Ab kadir |

Singapore |

|

| Wan Farhah |

Kuala Lumpur |

|

| Cut Intan Auliannisa Isma |

Jakarta |

|

| Laurie Adkin, Professor Emerita |

Edmonton, Alberta, Canada |

|

| Catherine Hume |

Toronto |

|

| Hala Shalan |

Amman |

|

| ALI ABN |

KUALA LUMPUR |

|

| Eben Kadile |

Graz |

|

| Heidi Paredes |

Serzedelo |

|

| Inga Steen |

Oslo |

|

| Sadiya |

|

|

| Sabah |

Amman |

|

| Nor Ghazali |

Kuala Lumpur |

|

| Azman Bin Kamaruddin |

Kuala Lumpur |

Support Ousman for telling the truth and to reinstate his current position with immediate effect. |

| Amin Desa |

|

|

| Sana Khan |

New Jersey, USA |

Thank you for your service to Humanity. |

| Yasmina Al sayeh |

Bahrain |

|

| Dina Kasrawi |

Manama, Bahrain |

Free speech is protected |

| Nadeen |

Bahrain |

|

| Dina Hayek |

Amman |

|

| Shaddin Almasri |

Vienna |

|

| Talal Sharaiha |

|

|

| Christoph |

Geneva |

|

| MAHA ALAMI |

New York |

|

| Khaled Abdel Majeed |

|

|

| Shaheen Hasan |

New York |

|

| Salah bustami |

New York |

|

| Marwa |

Dubai |

|

| Matt Perez Khouri |

Los Gatos |

|

| Nur Arafeh |

Virginia |

|

| Mary Gent |

|

|

| Imane B |

Paris |

|

| Mona El-Bayoumi |

Washington D.C. |

|

| Alessandro |

Geneva |

|

| Anita wadhwa |

|

|

| Anna Dollbo |

Rotterdam |

|

| Sahdya Darr |

|

I’d like it to be noted that I’m the former UK Campaign to Stop Killer Robots Coalition Coordinator. |

| Stephen Ballantine |

|

|

| Hajar Rahman |

Johor Bahru, Malaysia |

Do whatever we can to help the oppressed Palestinian people with your own methods and expertise |

| Sabah Hussain |

London |

Free Palestinian from apartheid occupation and hold Israel accountable for breaking international law on dozens of occasions, including prior to oct 7 2023. |

| Laia |

Barcelona |

|

| Lauren Schultz |

Long Beach |

|

| Nick Rush |

Salt Lake |

|

| Shafia |

Lampeter |

The Silencing Must STOP! |

| Sofia Surla |

|

|

| Oda Andersen Nyborg |

Oslo |

|

| Matthías Pétursson |

Reykjavík |

|

| Carlos Viteri |

Quito |

|

| Mary Nazzal |

|

|

| Rula Jardaneh |

Amman |

|

| Maha Abdallah |

|

|

| Mona |

Brighton – UK |

|

| Huwaida Arraf |

Detroit, Michigan |

|

| Eileen Weitzman |

|

|

| Leigha Gillespie |

New York |

|

| Charlotte Kates |

Vancouver |

|

| Sousan |

|

|

| Beth Breisnes |

British Columbia |

|

| Christopher Helali |

|

|

| Eric Geller |

Nashua |

|

| Rachel R |

Dallas |

|

| Aleta Toure |

Richmond |

|

| John West |

Chicago |

|

| Luci Murphy |

Washington, DC |

|

| Derrick Sosa |

Bay Area |

|

| Stanford McConnehey |

Davis |

|

| Haitham Mohsen |

Egypt |

|

| Moaz Elshebly |

|

|

| Mohammad MirBashiri |

London |

Miss you, Ousman! Been following your posts and supporting you all the way! Mo |

| Aby Sene |

|

|

| Hamzah Awad Hajeir |

Amman – Jordan |

|

| lush horizon |

Hillsborough |

|

| Ciara Taylor |

Chicago |

|

| Efia Nwangaza |

Greenville, SC |

|

| Garnett Achieng |

Dublin |

|

| Zeid Shaban |

Amman |

|

| Fida khwaja |

London |

|

| Yasser Taima |

|

|

| Iqra Imran |

New Delhi |

May justice prevail in your case Inshallah |

| Nancy demicheli |

Paris |

|

| Mariano delli Santi |

London |

|

| Lina |

Jordan |

|

| Mohammad Shaha Jalal |

Bangladesh |

Do Everything Good required for better Humanity for The sake of Allah. |

| Nour AlGharibeh |

Amman |

|

| Dalila YOUS |

Paris |

Free Palestine! |

| Lama Haj |

Riyadh |

|

| Lama Ibrahim |

Sharjah |

|

| Lara Haj |

|

|

| Stephen Ingle |

Quincy |

|

| Ahmad sarshar |

Vienna virgina |

|

| Nathan Best |

Geneva |

|

| Ruji Khan |

London |

|

| Kate Burns |

Los Angeles |

|

| Carol Grayson |

Newcastle |

|

| Tali Shapiro |

Israel |

|

| Claire Pannell |

Mandurah |

|

| Ruth Dawkins |

Hobart, Tasmania |

|

| Basma Tareq |

|

|

| Naheed Gilani |

Vancouver |

|

| Judith Muse |

Lunenburg |

|

| Robert Lipton |

Richmond, CA |

courage! |

| Martyn Hedley |

|

|

| Muhammad Khan |

|

|

| Zara Valentinova |

Madrid |

|

| Laith Mohammad |

Gothenburg |

|

| Ingunn Stray |

Kristiansand, Norway |

|

| Nadia Islam |

|

|

| Jo Murphy |

Dublin |

|

| Ahmed Jamal |

Gothenburg |

|

| Vjosa Morina |

|

|

| Jameson Joyce |

Congleton |

|

| Abla Khatib |

Rabat |

|

| Dr aleem |

The hague |

|

| Annabel Galt |

Bedlinog |

We must be free to stand up against genocide. Never again we said. |

| Saisha |

|

|

| BENNINI Houda |

Courbevoie (France) |

YOUR VICTORY IS OURS. |

| Eric Tibbott |

Wellington New Zealand |

|

| Jamilah Sherally |

Amsterdam |

|

| Warren Stapley |

London |

|

| Madina Kuiliev |

İstanbul |

|

| Suzanne Burns |

Milborne Port |

|

| F Toufik |

Houten |

Keep up the great work! Cease fire now |

| Hawwa Bobat |

Portsmouth |

|

| Mahfoodh Mohammed Al-Shaaili |

Mu |

|

| Vanessa Farr |

Sheffield |

|

| Randeep Samra |

Sheffield |

|

| Ylva |

Amsterdam |

|

| Choudhry kashif |

Orleans |

|

| Maha Elias |

Winscombe |

|

| Zulfiqar Ishaq |

Dallas, TX |

Stay strong. The end is for the believers. |

| amit mujawar |

|

|

| Sadaf Rahman |

London |

|

| Michelle W. |

|

|

| Mubariz S |

New York |

|

| Maureen Plant |

Abingdon |

|

| Hisham Mokhtar |

Kuala Lumpur |

Free Palestine |

| Majdi Mustafa |

Amman |

|

| Abdul Aziz |

London |

|

| Daniel K |

Sydney |

|

| Ricardo Lamour |

Montreal |

Signing also as 2023 OHCHR fellow |

| Lauren Councill |

|

|

| Robina Iqbal |

United Kingdom |

|

| Naima |

Rabat |

May justice and peace prevail for the sake of humanity! |

| Animah Kosai |

Nottingham |

Employees should have the right to speak up for human rights. It’s called being human! |

| Navideh Sadoughi |

|

How on earth, asking ceasefire is controversial?!? |

| Fareshta Touhami |

Ashburn |

|

| Sebastian Lillo |

Wiesbaden |

|

| Iman Bugaighis |

Tripoli |

|

| Ryan Ward |

Cambodia |

|

| Alegra Dajic |

|

|

| Mohammed |

|

|

| Hamza |

London |

|

| Ahmed Amin |

|

|

| Michael Khalsa |

Sydney |

|

| Sena El Banna |

United Kingdom |

|

| Zawar Khan |

|

|

| Iva Gumnishka |

|

|

| Yvonne Davies |

Herefordshire |

I hope you find justice |

| Mark Gerban |

Hamburg, Germany |

|

| M Abughazaleh |

|

|

| Umay Esencayi |

San Jose |

Free Palestine!❤️🖤🤍💚 |

| Lab Mehmeti |

Germany |

Keep fighting against genocide and freedom for all! May God bless you! |

| Mark Stanger |

|

|

| Natalie Strecker |

St Helier |

|

| Maitreyee Boruah |

Bengaluru |

Free Palestine |

| Mohamad Zeitoun |

|

|

| Melek Dogan |

Amsterdam |

|

| Wan nazmee Wan jaafar |

Kuala Lumpur |

|

| Ahmed |

|

|

| Maureen Kelsey |

Palermo |

|

| Kangere Njanja |

Nairobi kenya |

from the river to the sea Palestine will be free within our lifetime |

| Audrey Paterson |

Cairo |

|

| Seif Salmawy |

|

|

| Farhana |

London |

It is unacceptable and should be against the law how individuals are being treated |

| Samabia |

|

|

| Ali Sezgin Işılak |

Geneva |

|

| Aleks Palanac |

Leicester, UK |

|

| Zoë Spoudaia |

London |

|

| Eirini Aimiliani |

London |

|

| Anna Kalinowska |

Warsaw |

people have right to benefit from freedom of speech |

| Pav Akhtar |

London |

|